Secluded Consider Put

After you have caught the pictures, complete the money purchase from the application. Some software can get allow you to submit more details, including the number and the memo. Double-make sure that every piece of information are accurate just before entry to prevent one errors otherwise delays. As the consider features removed, wreck they straight away by shredding it otherwise playing with various other safe method. Should your photos your’ve taken is actually fuzzy, retake her or him by the reduced moving nearer to otherwise farther of the fresh view that it’s within the greatest attention.

Click this link here now – Detach view stubs or spend slips

Don’t ignore so you can check the fresh terms and conditions just before taking people incentive whether or not, simply to guarantee the incentive really is as good as they appears. Might receive a message verification just after a cellular Put provides become submitted. A second email was generated if put might have been examined to inform you the new position of your put.

A good. Factor of one’s Criteria and you can Limits from Cellular Deposit a money Purchase

To begin, call one of many using banking companies or credit unions listed on the newest VBBP webpages. Bail costs is actually processed by TouchPay Holdings, LLC dba GTL Financial Characteristics, a licensed Money Sender, and you will susceptible to TouchPay’s Terms of use and Privacy. The newest app records display screen shows exactly what might have been transferred to the application and you can remains so you can opinion that which you deposited. See My Deals to see an up-to-date look at of your account record. Don’t worry, whenever we find that the newest cheque wasn’t paid in before you are going to discover your finance, there will just be a slight slow down these types of becoming available in your account.

popular features of cellular banking: Benefit from your account with our advantages

The fresh cellular software lets you know once you’ve reached your month-to-month put limit. To minimize the risk of scam, financial institutions fundamentally impose limits to the mobile take a look at deposits. The brand new principles vary by the financial and you will account click this link here now , however, there is certainly limitations about how much users is put daily, each week otherwise monthly. Mobile consider transferring allows a customer to store effort from the transferring a check from another location on their mobile thanks to a great bank’s mobile application. To the go up away from digital banking, people can now over of numerous common banking services online otherwise playing with an excellent bank’s mobile application, as well as transferring checks. Be sure to understand and know the provider’s rules prior to playing with the fresh mobile put feature to stop any things or delays.

We recommend your talk to a financial or taxation coach when to make benefits to help you and you can withdrawals from a keen IRA bundle membership. You can now easily put a check for the Checking account of wherever you’re using the Amex Application. Transferring together with your mobile phone bill is as simple as choosing the commission solution on the Money web page. However, it’s important to consider the huge benefits, including swift deals and you will increased defense, contrary to the limitations, including withdrawal constraints and you may it is possible to exchange charge.

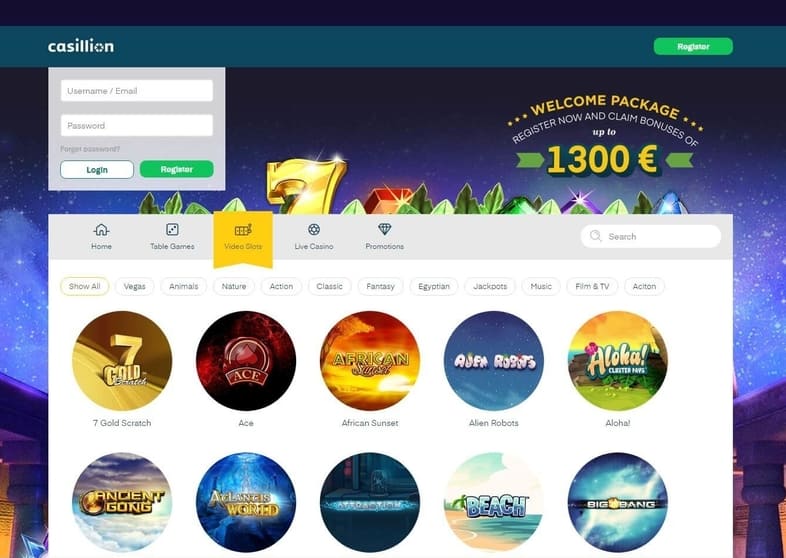

You’ll and find Pay it off and you can PayByPhone offered by specific pay-by-cellular casinos in the united kingdom. Zimpler and you can Siru Mobile commonly but really designed for British participants. Boku keeps track of the investing across online casinos and other websites, so this £31 investing limit is a rigorous cellular placing limitation.

You could potentially log in to the brand new software and you will availability the account safely twenty four/7 by using the most advanced technology in addition to Reach ID and you can single-explore defense requirements. If you believe the new application can be off, contact your lender instantly to see if some other clients is actually having the exact same issue. In that way they can earnestly strive to have the app straight back in form about how to put your own take a look at. Certain banking institutions will let you put a limit about precisely how far you can deposit in your bank account.

You can even not want to quickly spend various or thousands without having to be sure of what you are really doing. Thus, i come across security features for example SSL-encoded connectivity and you can commission protection. Places designed to your finances during the retailers from Environmentally friendly Mark System will get sustain a charge as high as $4.95 for every exchange. Users of online-merely bank LendingClub is also deposit bucks in their membership at any NYCE Common Deposit ATMs and you can MoneyPass Put Getting ATMs. And then make a deposit at the one of these stores, simply remain in the brand new register and ask the new cashier to add the cash to your Axos debit card. You can include people matter ranging from $20 and you will $five hundred at any of those cities, and some Walmart and Expert Bucks Share cities allow you to add more.

In the event you you want relatively quick access on their mobile take a look at deposit financing, lots of banks give either exact same-day otherwise 2nd-date accessibility. Just remember you to while you are mobile deposits can be made any time throughout the day, just after specific cutoff times, you may need to waiting a supplementary business day for the finance to be readily available. Some financial institutions may not accommodate cellular deposits to your certain issues, for example overseas inspections, thus make sure to review your own bank’s regulations beforehand. If you want to gamble on the internet but don’t want to express delicate financial investigation, next a cover by the mobile phone costs gambling enterprise is a superb option.

But not, signing into your financial software to your societal Wifi you will sacrifice your own defense, that it’s smart to just use cellular deposit to your a trusted community. Should your latest account doesn’t give this feature, it can be worth researching checking profile to get one which includes mobile consider put and other useful electronic financial have. For many who’re concerned about protecting the financial information online, you are wanting to know if mobile view put is secure to help you play with. The newest quick response is you to cellular consider deposit can be as secure as your almost every other on the internet and cellular financial services. As previously mentioned above, just because your put a check using your bank’s mobile software doesn’t imply you might put from the look at.

If at all possible, there must be multiple percentage tips one Americans commonly explore. The fresh withdrawal times should be fast, so there will be very little fee costs. Pursue QuickDeposit℠ try susceptible to put limits and you can finance are generally offered from the 2nd business day. See Pursue.com/QuickDeposit and/or Pursue Mobile application to have qualified mobile phones, restrictions, words, criteria and information.

- With your mobile phone bill in order to better right up is a lot like gambling with credit and will end up being a little trickier to keep track out of.

- To make the groups finest for our neighbors, our very own members of the family, all of our people, and ourselves, we should instead participate the alteration.

- The brand new Irs assumes no responsibility to have tax preparer otherwise taxpayer mistake.

- Availability – Shell out because of the cellular phone costs casinos are coming all day, while the SA gamblers request the newest fast and safe mobile payment services.

- Most other financial institutions may have particular advice away from cancellations, so check with the customer service team to learn more about the choices.

- This includes British Regulators Payable Orders, postal sales, bankers’ drafts and Building People cheques – although not travellers’ cheques, financial giro credits as well as other low-fundamental cheques.

Once you transfer a keen IRA, an agent membership, otherwise a medical family savings (HSA) in order to Fidelity, it’s called a move away from assets. You can want to import just some of your bank account, otherwise almost everything. If or not you’ve got a retirement account away from a former boss otherwise an agent account from the other lender, we are able to make it easier to effortlessly transfer their accounts in order to Fidelity. Currency you place in order to 529 university savings plans and later years profile, along with IRAs, 401(k)s, or 403(b)s, is frequently titled a contribution.

You don’t need ask for fee directly in another email address — you only need to ensure that your buyer understands your own fee words and you will very first information beforehand. Because the purpose of your charge email address is always to provide your client to the necessary information regarding their percentage, make sure the system of your own email is just as short term and you can instructional that you could. Here’s the best way to words every person requesting payment current email address your publish for the buyer and politely ask for fee. I have 6 other payment demand email layouts you could obtain and rehearse. As long as you stay elite group, direct, and accurate in your consult — your own payment note may pay back ultimately. The same goes to possess times when you will do the task to the time and up coming wait months for the consumer to repay the new invoice.

Having Head Put, your finances happens right to the PayPal equilibrium. Make use of it to buy, post money, transfer financing to help you PayPal Discounts,cuatro otherwise get a start on your own costs. After a few months, as he saw the new put put in his Chase account, the guy shredded the newest take a look at. And you can associated banking companies, Professionals FDIC and you can entirely possessed subsidiaries from Bank of The united states Corporation (“BofA Corp.”). As the The start production are provided to own fund that have lower than 10 numerous years of background and they are since the brand new fund’s first go out.

Along with for those who’ve starred from the an online site i’ve skipped and you can think we would like to learn about they, e mail us via Fb. Simpler, smarter financial begins with the newest Axos all-in-one cellular application. You need to have a web connection to process the newest transactions efficiently to your all of our gambling system because this is an online payment. Today, the bucks will be energized to your player’s cellular expenses and you will the brand new related currency was placed to the player’s Vegas Cellular Gambling enterprise account. Action 5 Go into the good cellular amount and then click to your ‘Update’ option. Enter the recognition code once it’s sent to the fresh particular phone number.

Within this video clips, we’ll show you learning to make in initial deposit regarding the Digital Financial software. Start by log in, following check out Flow Money and choose “Take a look at Put”. Make sure to indication the rear of the fresh consider and you may produce “DCU Cellular Put Only”. We see zero causes your shouldn’t choice because of the cellular phone statement one or more times. If you are Age-wallets always obtain the nod, which payment experience while the secure as it gets when you are coming which have a plethora of benefits.