How frequently ought i explore an effective Va mortgage?

Why don’t we have a look at a situation to the left entitlement. We’re going to suppose you already individual a home which you ordered for $200,000 with a great Virtual assistant mortgage with no downpayment. Thus, you had to utilize $fifty,000 value of entitlement buying they, otherwise twenty-five% of cost.

If you’re not expecting to promote the house, it’s also possible to ensure that it it is and you can book it for now. You can find their remaining entitlement information regarding your Certification from Qualification payday loans in Redstone CO online (COE). You really need to have your own COE in hand beforehand seeking crisis quantity on your bonus entitlement.

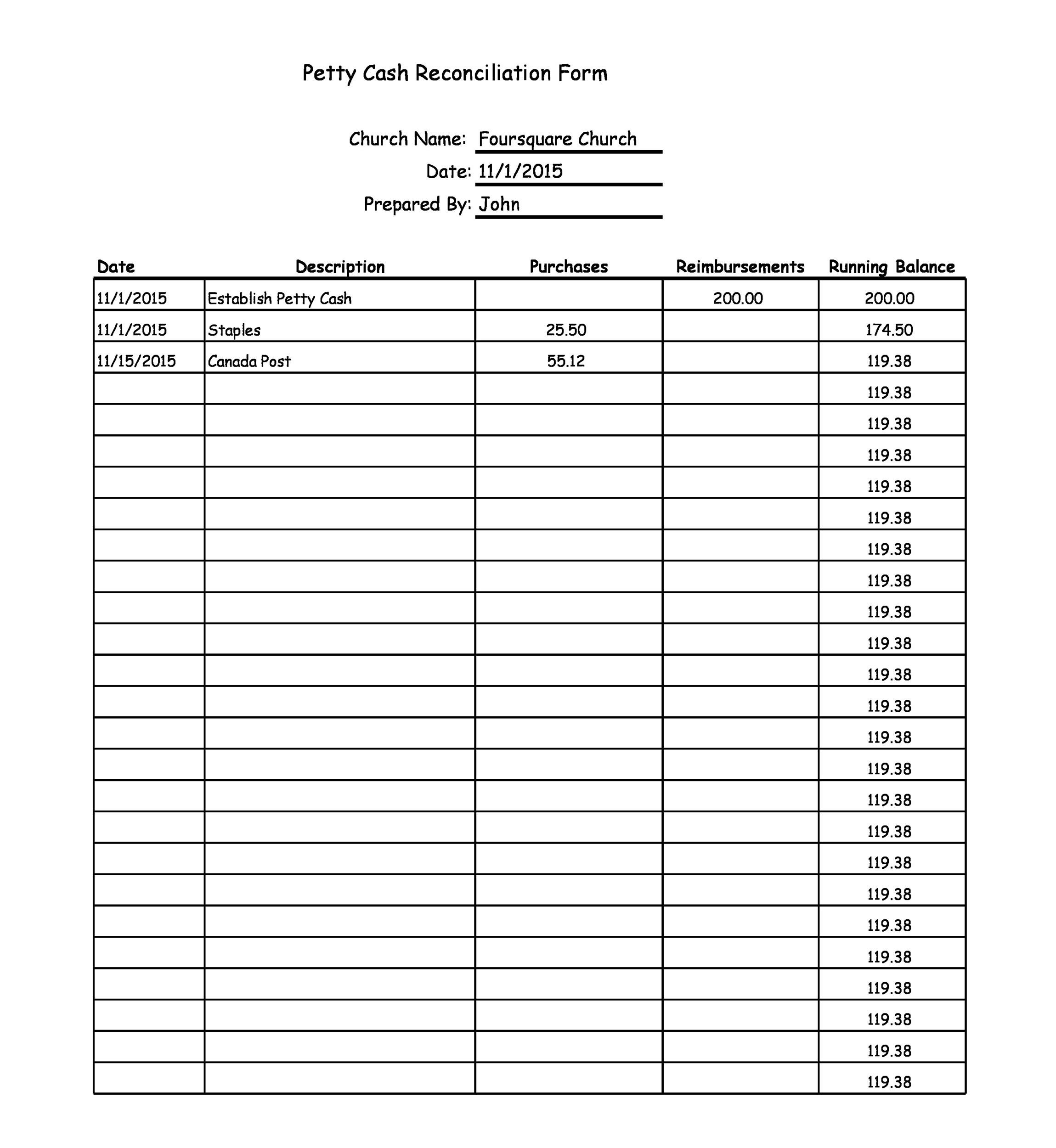

Lower than try a good example of exactly what your Certificate regarding Eligibility appears such. You have to know brand new Total Entitlement Charged to help you Prior Va Funds effectively assess your own extra entitlement and limit amount borrowed to buy other house or apartment with the Va financial work with.

If you’re transferring to a neighborhood where condition loan limitation is $510,eight hundred, and also the household you are interested in to shop for is actually $250,000, the main benefit entitlement formula was below:

Basic, proliferate your regional loan limit from the twenty-five% to get the maximum Virtual assistant make certain. In such a case, its $127,600.

2nd, your subtract the level of entitlement you’ve currently used regarding the restrict verify to decide how much cash extra entitlement you may have leftover.

The Virtual assistant makes it possible to obtain as much as fourfold the degree of their offered entitlement to own yet another financing; $77,600 x 4 = $310,400. The fresh $310,400 contour ‘s the restrict loan amount you’ll score instead a downpayment. The $250,100 house is beneath the restrict restrict, meaning you will be capable purchase the brand new home no advance payment.

Consumers which have kept entitlement try susceptible to brand new 2021 Va mortgage maximum, that is $548,250 for example-device properties for the majority elements of the us

Since the $250,000 house you are thinking of buying is below the new $310,400, you would not have to create an advance payment.

Knowledge financing limits

You can look in the precise conforming financing restriction on your state toward Federal Construction Funds Institution (FHFA) site. Many regions of the world has a max Va loan restrict off $548,250, particular large-rates elements provides restrictions which go doing $822,375.

Va money commonly a one-go out benefit; one can use them several times so long as you fulfill qualifications criteria. You may features multiple Virtual assistant financing at the same time. This is how it may functions:

> Your sell your residence and you will pay-off current Virtual assistant financing. You might often repair your entitlement otherwise make use of leftover entitlement to fund yet another Virtual assistant mortgage.

> You can keep your household and you can rent it out once the a residential property. You can purchase an extra family making use of your leftover entitlement. It causes which have a couple Va funds outstanding at the same go out.

> You have reduced the earlier Virtual assistant loan completely however, leftover the ended up selling the house you bought involved. In this situation, you repair their entitlement, you could only do this single.

It is essential to understand how to heal your entitlement work with in the event that we need to use an excellent Va financing getting an extra home. New fix processes is not automated and should be initiated from the the newest seasoned. To get entitled to fixing their entitlement, you truly need to have both offered the house you purchased that have a beneficial Virtual assistant financing and you may paid off the borrowed funds, paid back the loan entirely and still individual the house or various other accredited veteran assumes your loan and you will substitute its entitlement that have your own personal. If an individual of those conditions applies to you, you can request maintenance of the entry Function twenty-six-1880 Request for Certification away from Qualification to help you a nearby Va processing heart