Exactly how Is actually a housing Mortgage Unlike a mortgage?

While you are looking for an alternative household, it is likely that that you’ll require financing to aid purchase they. Plus that lookup, you’ve probably look for a couple of different varieties of loans: mortgages and you may design fund. While they both safety the expense for an alternate household, they do differ in many parts like:

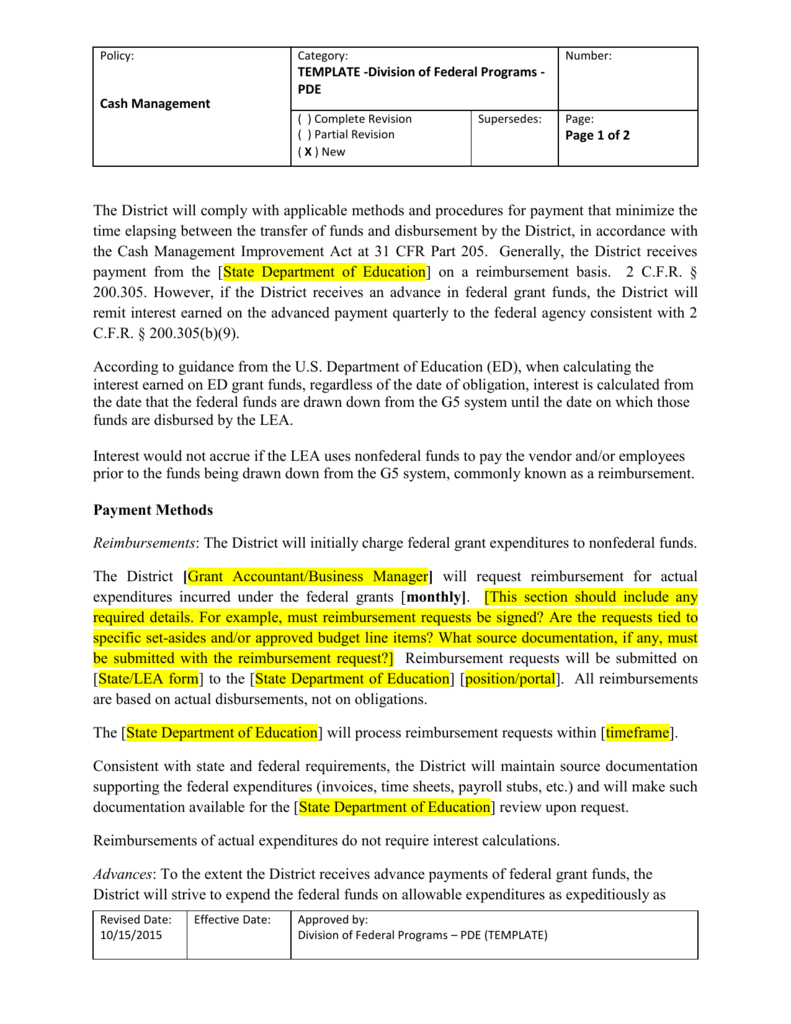

Build loans require reveal package in addition to how long it does simply take, just how much you can spend, deal towards the builder, and you will estimated appraisal level of the fresh accomplished household

- What type of house they are utilised to have

- Once you get the money

- Rewards periods

I coverage this type of distinctions and supply facts to the a casing financing compared to a home loan away from Indiana Participants Borrowing from the bank Relationship (IMCU) through the this blog.

A houses financing is certainly one that you apply to fund a property you are strengthening. That money can go to your monitors, materials, homes, designers, and you may other things you ought to complete the investment. Mortgages only pay to possess households one to already exist. And if you’re interested in strengthening your upcoming family, you’re going to have to choose a construction financing. One another products may be used when you are incorporating to a preexisting domestic.

Mainly https://paydayloancolorado.net/edgewater/ because several financing differ about home it protection, nonetheless they are different in the when you can have fun with that money, criteria to get all of them, and how enough time it past. Why don’t we take a closer look at every difference between a construction loan and a mortgage:

Design money want an in depth bundle including just how long it can capture, how much cash you can easily purchase, price towards the creator, and you may projected appraisal number of the fresh complete home

- Whenever you can make use of the currency: When you take aside home financing, the full quantity of the mortgage are applied within closing. However, somewhat little bit of a construction mortgage try used from the a time. That is because the lender would like to make certain that the fresh construction of your property is certainly going since arranged. You will get a portion of the loan at first each and every stage of building procedure. At the end of for each phase, an inspector need to come-out to evaluate improvements one which just keep strengthening.

- Collateral: Which have an interest rate, your property acts as guarantee. If you can’t pay-off your mortgage, the lender takes your residence. With framework funds likewise, you don’t need to to add any significant security.

- Rates: Structure loan rates of interest is higher than the individuals to own mortgage loans because you dont provide equity to have construction money. With design finance, you only have to pay attract into the build of one’s family. You then afford the kept balance when your residence is completed. You might pay they in the form of bucks otherwise a good antique home loan. Having a property-to-permanent mortgage, it will instantly turn into a mortgage. You pay one another desire and also for area of the loan by itself monthly if you have a mortgage.

- Down payment: Framework money commonly require a larger deposit than just mortgages simply because they do not require security. That count is normally 20-30% of one’s strengthening rates while the mortgage downpayment count can be may include 3-20% of your house’s really worth.

- Duration: A property financing usually merely lasts 12 months. This is because it just pays for the development of the property in itself, that should be completed in a-year. You will need home financing just after your home is totally founded. Which have one kind of build loan, you have to get home financing by themselves. Towards the other type, a construction-to-long lasting financing, your framework mortgage tend to instantly transition to your a home loan as soon as your residence is over. Mortgage loans bring much longer than simply construction loans to repay. It will take you 15-three decades to take action.

Build loans need a detailed package and how much time it can bring, exactly how much you can spend, deal toward creator, and you can projected assessment number of the new complete family

- A credit rating out of 680 or more

To acquire property is an important action to manufacture a lifestyle for your self. At the Indiana Users Borrowing, we require you to find the household you have always wanted. For this reason i have both framework funds and you can mortgages for any sort of you to dream works out.

At Indiana Professionals Credit Partnership, we require at least FICO credit score to own a property financing from 680. With our build to permanent loan, we provide:

While you are willing to pick a property and want to get it done having a lender which cares for you and you can the community, listed below are some your own framework loan choices or their mortgage solutions towards the our site.