Conforming Financing: What it is, How it operates, vs. Conventional Mortgage

What is a compliant Financing?

A conforming financing are a home loan that meets new money constraints put from the Federal Homes Funds Agencies (FHFA) and money criteria regarding Freddie Mac and you can Federal national mortgage association. Having consumers that have advanced level credit, compliant funds are beneficial along with their low interest rates.

Key Takeaways

- A conforming financing is a home loan that have fine print you to definitely qualify away from Fannie mae and you will Freddie Mac https://clickcashadvance.com/payday-loans-mo/ computer.

- Compliant financing do not go beyond a specific dollar maximum, and therefore changes a year. Inside the 2024, the newest restrict try $766,550 for almost all components of the fresh new You.S. but is large in some more expensive components.

- Conforming funds generally offer all the way down rates of interest than many other particular mortgages.

- Lenders choose point compliant fund because they can feel packaged and bought in the fresh second home loan markets.

Exactly how a conforming Mortgage Work

The fresh new Federal national mortgage association (FNMA, otherwise Federal national mortgage association) while the Federal Financial Mortgage Enterprise (FHLMC, otherwise Freddie Mac computer) was government-backed organizations that push the market industry to own lenders. These types of quasi-governmental agencies have created standard regulations and guidelines to which mortgage loans for one-unit characteristics (single-family dwellings) need certainly to stick when the eligible for this new agencies’ backing.

Fannie mae and Freddie Mac do not procedure mortgages on their own. Instead, they insure mortgages granted of the loan providers, such as for example banks, and try to be secondary market firms if lenders desire to offer those individuals mortgages.

The fresh new FHFA enjoys regulatory oversight making sure that Federal national mortgage association and you can Freddie Mac fulfill their charters and you may objectives out of promoting homeownership having lower-earnings and you may center-classification Us citizens.

Mortgage Restrictions and Regulations

The word conforming is often accustomed explain the borrowed funds amount, not as much as a particular buck profile, or mortgage limitation, place on a yearly basis because of the FHFA.

Getting 2024, it baseline restrict is actually $766,550 for many of your United states. In some high-costs segments, like San francisco bay area and you may New york city, this new maximum is large. This new 2024 roof for these elements was $1,149,825, or 150% regarding $766,550.

Special statutory terms introduce additional mortgage constraints for Alaska, Hawaii, Guam, and U.S. Virgin Isles, where in fact the standard mortgage limitation is also $step 1,149,825 for one-unit attributes inside the 2024.

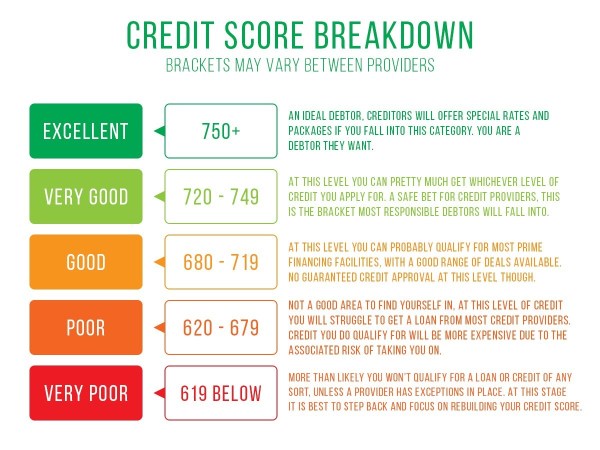

In addition to the size of the borrowed funds, most other advice to which compliant money must stick to include the borrower’s loan-to-value (LTV) proportion, debt-to-income proportion, credit history and you can history, and you will paperwork criteria.

Crucial

Initial fees with the Federal national mortgage association and you can Freddie Mac computer mortgage brokers altered into the . Charges had been improved to have homebuyers having high fico scores, such 740 or more, because they was in fact diminished having homeowners having lower credit ratings, such as those below 640. Another alter: Your own down payment commonly determine what your percentage are. The better your own advance payment, the reduced the charges, though it commonly nevertheless depend on your credit score. Fannie mae will bring Loan-Peak Speed Adjustments to the their webpages.

Benefits of Conforming Fund

To own users, conforming fund are extremely advantageous using their low interest rates. To own earliest-go out homebuyers taking out fully Government Construction Administration (FHA) finance, such, the fresh new down payment is really as reduced as the 3.5%.

not, the consumer who can make the lowest advance payment may be required to order home loan insurance coverage, the cost of hence is dependent on its loan’s words. Like, to own 31-year funds of $625,five hundred or quicker, having a keen LTV proportion greater than 95%, the cost is about 0.85% of the amount borrowed per year.

Lenders and additionally want to work with conforming loans, that is packaged easily into investment bundles and you can purchased in brand new additional financial market. This step frees upwards an economic institution’s ability to point way more financing, that’s how it tends to make currency.

Compliant Financing against. Nonconforming Financing

Mortgages one to surpass brand new conforming financing maximum are known as nonconforming otherwise jumbo mortgage loans. Since the Fannie mae and you can Freddie Mac computer only pick compliant money in order to repackage towards the secondary business, the new need for nonconforming funds is much quicker.

This new terms and conditions off nonconforming mortgage loans can vary extensively out-of financial so you’re able to financial. Nevertheless, the rate and you may lowest advance payment are usually large since these types of fund hold higher risk to possess a lender. Not simply is far more money inside it, but the mortgage can’t be secured by authorities-sponsored organizations.

Homebuyers who want a mortgage one is higher than brand new conforming loan limitations can occasionally get around the issue by firmly taking out a few quicker mortgages in the place of a single jumbo loan.

Compliant Money versus. Traditional Money

Conforming funds are occasionally confused with traditional financing/mortgage loans. Whilst 2 types convergence, they may not be the same. A normal financial try a much wide classification. Its people mortgage offered as a consequence of an exclusive financial, rather than a federal government agencies for instance the FHA or the U.S. Institution off Veterans Situations (VA), or backed by Federal national mortgage association otherwise Freddie Mac computer, that is in which people convergence-and you may confusion-pops up.

The size of the borrowed funds cannot apply at if or not home financing was conventional. In effect, the conforming money try conventional, however all traditional finance be considered given that conforming.

FHFA Legislation

The fresh new FHFA provides regulatory supervision to make sure Fannie mae and Freddie Mac computer satisfy its charters and you may objectives off producing homeownership to have lower-earnings and center-class Us citizens.

In mandate of your own Property and you can Financial Healing Act (HERA) out of 2008, the conforming mortgage restrict are adjusted per year in order to mirror alterations in the common household rates in the us. The fresh yearly restriction is determined because of the Fannie Mae’s and you may Freddie Mac’s federal regulator, this new FHFA, and you can announced during the November for the following seasons. The fresh FHFA uses the Oct-to-Oct percentage improve/reduced amount of the typical family rates, just like the indicated at home Price List statement, to adjust the brand new compliant financing restrict to your then year.

Since the FHFA uses our home Rate Directory to find the following the year’s loan limitations, the fresh yearly grows into the financing constraints are very automatic. Each time home values rise, the newest FHFA increases the mortgage limits.

What Agency Handles Compliant Mortgage loans?

The new Government Houses Financing Agencies (FHFA) ‘s the You.S. authorities service one manages mortgage avenues, also statutes getting compliant fund.

What is a good example of a non-Compliant Mortgage?

Funds backed by new Company of Pros Things (VA), Government Houses Government (FHA), and you will U.S. Service out of Agriculture (USDA) was low-conforming mortgage selection.

Why are Standard Compliant Mortgage Restrictions Lay From year to year?

New Casing and you will Economic Recovery Work (HERA) necessitates that the baseline compliant financing limitations is actually adjusted from year to year to reflect the change on average You.S. home rates. HERA are a piece of monetary reform legislation approved by Congress as a result into the subprime mortgage drama regarding 2008.

The bottom line

A conforming real estate loan match the fresh buck limits lay from the Government Casing Fund Company (FHFA) and financing requirements out of Freddie Mac computer and you will Federal national mortgage association. Such businesses provides standard rules to which mortgages to have solitary-friends homes need adhere. Mortgage loans you to meet or exceed the brand new conforming loan maximum are classified as nonconforming otherwise jumbo mortgages.