Breaking: Way more School Grads Become FHA-Recognized When you look at the 2016

Alot more Students Are Approved During the 2016

The fresh guidelines with the studies financing will make it more comfortable for present students – and many more having pupil obligations – discover accepted into the 2016.

Energetic instantly, education loan payment computations has eased. FHA lenders commonly now fool around with lower monthly payment prices to have deferred student education loans.

Which have lower home loan prices and much easier qualification having college graduates, 2016 is getting an excellent seasons for more youthful home buyers.

Student education loans Keep Of numerous Students Out of Purchasing

The common student loan loans an excellent 2015 scholar is all about $thirty five,000 to have a beneficial bachelor’s degree, $51,000 to possess an excellent Master’s and you can $71,000 to possess a beneficial Ph.D.

Men and women wide variety is actually trending upwards, also. Into the 2012 students sent a median amount borrowed away from $26,885pare you to just to $twelve,434 twenty years in the past.

Student loan loans tend to weighs off graduates for a long time. There are lots of forty-year-olds which might be however settling figuratively speaking. To them, student loan debt features spanned a whole age bracket.

Because of rule alter out-of Property and you will Urban Invention (HUD), the institution you to oversees the popular FHA mortgage system, students will receive an easier go out being qualified to have property financing.

Here you will find the FHA Education loan Rule Changes

Of a lot 2016 home loan individuals with education loan financial obligation will dsicover that the likelihood of purchasing property was greatly enhanced.

Of several recent students has deferred student loans. They’re not necessary to make costs up until a quantity of your energy after graduation. This provides all of them time for you start their professions, and begin getting a pay-day.

This really is an advantageous plan. But once such college or university grads submit an application for home financing, the financial institution need reason behind upcoming student loan repayments. Have a tendency to, no percentage info is offered.

Thanks to 2016 position, lenders tend to imagine deferred student education loans just one percent of the borrowed funds equilibrium when the zero commission info is readily available. Which effectively halves the latest feeling out of deferred student loans on the mortgage app.

Keep in mind that this laws applies to college loans getting hence no commission data is offered. Whether your real payment looks towards credit history otherwise loan files, the better of your own genuine payment otherwise 1% of your balance will be employed for qualification aim.

But really, getting people whom are unable to document the next education loan fee, it relatively brief change have deep effects acceptance.

The Rule Change Can take advantage of Aside For your requirements

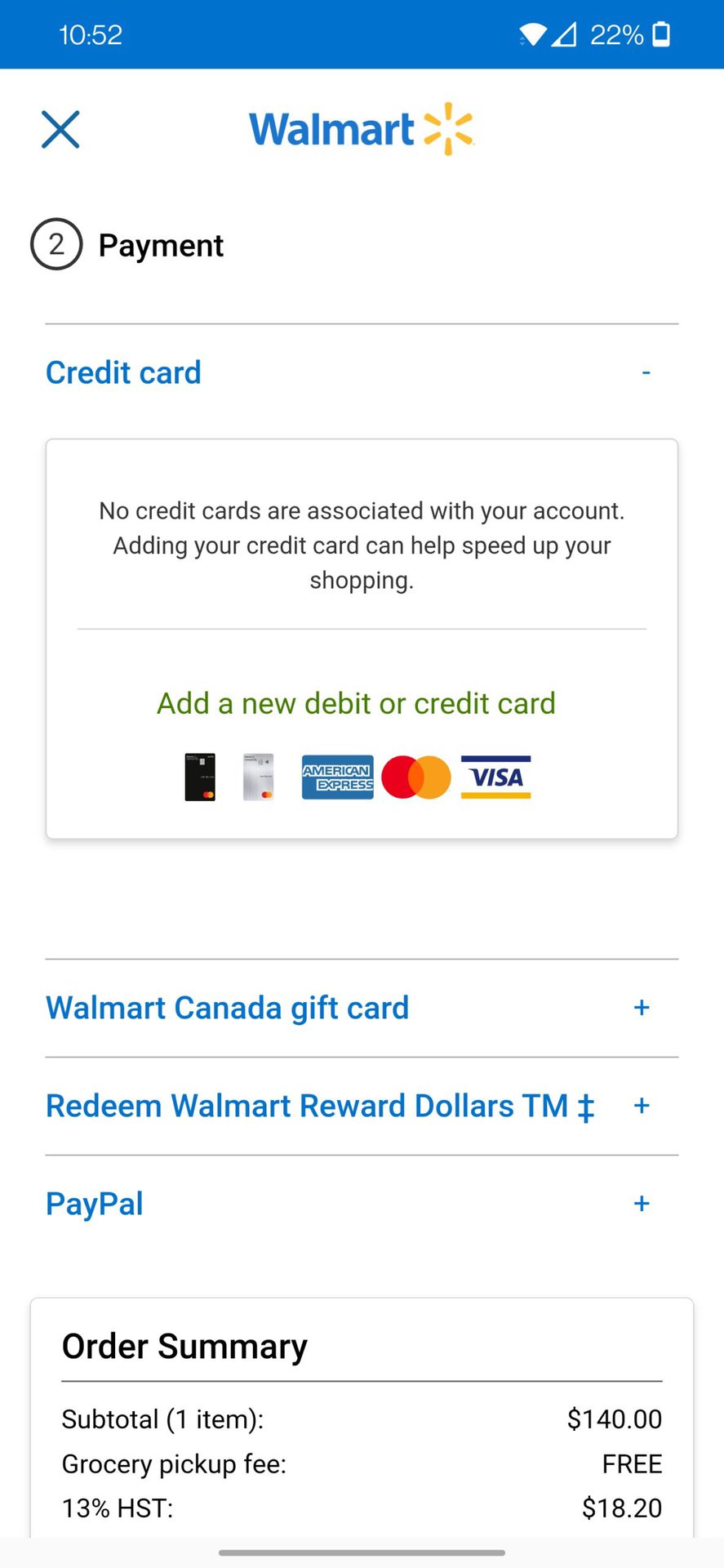

Need this situation. A recent graduate finds out a position straight out out-of university. She renders $cuatro,000 four weeks. Their particular total monthly payments in the event that she shopping a house could be $step 1,five-hundred four weeks plus her upcoming home fee, a motor vehicle fee and a charge card.

Below former laws, their unique projected percentage is $400 30 days. It places their unique loans-to-earnings proportion at a rate that is excessive to-be approved.

Around the new rules, the financial institution rates their own student loan payment just $200, or step one% out-of their unique financing balance. Their particular personal debt-to-earnings is within this appropriate levels, and this woman is acknowledged getting a mortgage.

$29,000 during the college loans: $300 monthly loss of projected money $50,000 in the student loans: $five-hundred per month losing projected money $100,000 when you look at the figuratively speaking: $1,000 four weeks reduction in projected costs

The brand new applicant’s to invest in strength is actually improved by the amount the estimated percentage reduces. Quite simply, property consumer having $fifty,000 from inside the college loans is now able to be accepted to have a property payment which is $500 large.

Just remember that , whether your genuine commission can be acquired, the lender use that matter, in case it is higher than brand new step 1% imagine.

In addition, when the step one% of your financing harmony are higher than the actual commission towards the mortgage files otherwise your credit history, the lender need make use of the one to-percent contour.

The fresh FHA guidelines around deferred figuratively speaking, although not, often discover homeownership possibilities to a whole population which had been locked from home ownership simply weeks back.

FHA Guidelines You can expect to Change Clients To your Customers In the 2016

First-date customers portray a typically lowest portion of loan places Old Mystic the fresh . Considering , new buyers comprised 32 per cent of all homebuyers.

This is the second-reduced understanding once the a property exchange providers been producing studies when you look at the 1981. First-go out domestic buyer account haven’t been this lower due to the fact 1987.

Ever-rising rents and all income tax benefits associated with homeownership tend to encourage renters to more you should think about to purchase a house. And you can student loans might no stretched stop all of them out-of going right through on it.

So it opens up a rare window of opportunity for home buyers: latest students can afford alot more home at a lower price owing to reasonable rates.

Just what are The present Pricing?

For those who have high education loan obligations, consider a keen FHA mortgage, that has recently loosened its guidance doing estimated loan costs.

Rating a speeds estimate if you are rates was reasonable and you can recommendations is actually accommodative. You are surprised at the home your qualify to acquire right now.