Exactly what can I use a funds-Away Re-finance To own?

Sure, normally you should get a house appraisal to possess a great cash-away refinance. The latest appraisal gives a formal measurement of one’s residence’s really worth, that’ll regulate how far currency you could potentially dollars-out.

How much cash Can i Cash-Away?

Say you have got an effective $eight hundred,000 mortgage thereby far, you paid down $250,000, leaving an unpaid balance away from $150,000. While you are attempting to access $100,000, your brand-new mortgage loan amount would be $250,000. That is $150,000 on the kept harmony, and you may $100,000 into the security you’re being able to access. Keep in mind that you almost certainly won’t be able to help you take-out 100% of house’s equity the brand new maximum LTV (loan-to-worth ratio) can often be 80%. This particular article does not include even more fees on the refinancing will set you https://paydayloanflorida.net/montverde/ back.

Things! Its your own. not, as you’re going to be make payment on money back, it’s wise to use it to own worthwhile investment, such as home improvements. So it contributes well worth to your home, so you might be capable of geting much more for this when it comes time for you promote. As they say, You have got to spend cash to make money.

Other preferred simple ways to use so it currency is merging highest-desire credit card debt, that’ll help boost your credit history. You might like to purchase your child or grandchild’s upcoming of the deploying it to possess educational costs. However, you can use it any way you like! Just be sure that one may keep up with your brand-new repayments.

Whenever i Do a cash-Away Refinance, Whenever and exactly how Perform I Have the Financing?

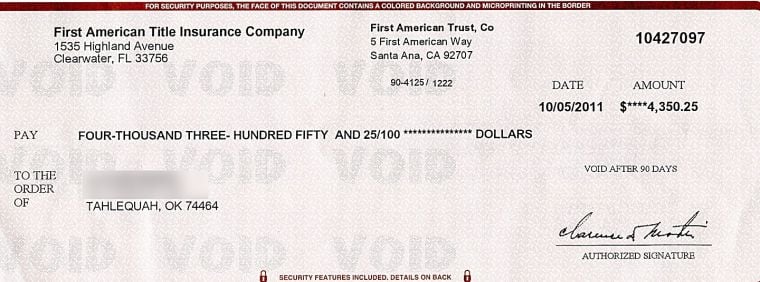

Generally, you’ll get the cash during the a lump sum payment at the closure. Although not, if you have an effective rescission period, gives your day immediately following closing in order to rescind the borrowed funds, possible hold back until the conclusion that time to really get your bucks.

What do I would like Getting a profit-Out Refinance?

- W-2s/Tax returns

- Shell out Stubs

- Bank Statements

- Credit report (always a credit rating of at least 580)

You can even you desire almost every other papers, based on your role and lender. While doing so, it is critical to note that you will be guilty of settlement costs, and every other brand of charges you incur.

Bringing dollars-away household re-finance are a sensible disperse if you like dollars and possess based specific collateral. Plus, now is an enthusiastic opportunistic time to refinance! If you find yourself ready to access your own home’s collateral which have a profit-away refinance, you can apply for home financing on the web now.

Are you good Newrez Household Security Loan second home loan or an earnings-away refinance? Apply at financing administrator to know about the quintessential fitting financial highway for you! Name today at the 888-673-5521!

dos The interest rate in your existing financial doesn’t transform. The fresh Newrez Home Guarantee Loan program need borrower to track down an effective next home loan in the most recent ount according to underwriting guidelines. Minimal 660 credit rating. Minimal and you may restrict mortgage quantity apply. System capital limited into qualities with that established home loan lien and you may susceptible to maximum mortgage-to-worth ratio. Unavailable in most claims or territories. Almost every other terms and conditions and you will constraints implement. Delight e mail us for more information.

3 By the refinancing an existing loan, the full financing charges is highest across the life of the borrowed funds. We possibly may import their escrow balance from your own most recent mortgage into the the newest financing. If the current escrow number is not enough on account of changes in taxes otherwise insurance policies, we possibly may want more money when you personal in your new loan.

2023 Newrez LLC, 1100 Virginia Dr., Ste. 125, Fort Washington, PA 19034. 1-888-673-5521. NMLS #3013 (nmlsconsumeraccess.org). Working as Newrez Mortgage LLC regarding the county from Tx. Alaska Lending company Licenses #AK3013. Arizona Home loan Banker Licenses #919777. Registered because of the Agency out-of Financial Coverage & Creativity under the Ca Domestic Financial Financing Operate. Financing produced otherwise install pursuant so you’re able to a ca Money Lenders Law permit. Massachusetts Bank #ML-3013. Registered because of the Letter.J. Agencies regarding Banking and you may Insurance coverage. Authorized Financial Banker-NYS Financial Agency. More permits offered at newrez. So it telecommunications cannot compose a partnership so you’re able to provide and/or be sure off a specified interest. Loans protected of the a lien up against your residence. Software requisite and subject to underwriting recognition. Never assume all people could be approved. Interest at the mercy of transform due to markets standards. If you do not secure a speeds when you use, your rate in the closing can vary from the rate in effect once you applied. Initial home loan advanced ount. Important information related especially towards loan would-be within the loan records, which by yourself should determine their rights and personal debt beneath the financing package. Fees and charges implement and may even will vary by product and you may jurisdiction. Need info. Words, criteria, and you may limits use