Just who qualifies once the a first-big date homebuyer into the Florida?

> 6. Execute your loan. After you’ve an agreement to acquire a house, your lender offers recommendations toward papers you prefer to help you completed the loan. The lender commonly purchase an assessment of the home to decide their worth. You will additionally must find home insurance and you may policy for utility profile on brand new home.

> 7. Personal into home loan. Within closure, you can signal all of the paperwork then have the secrets to your brand new family.

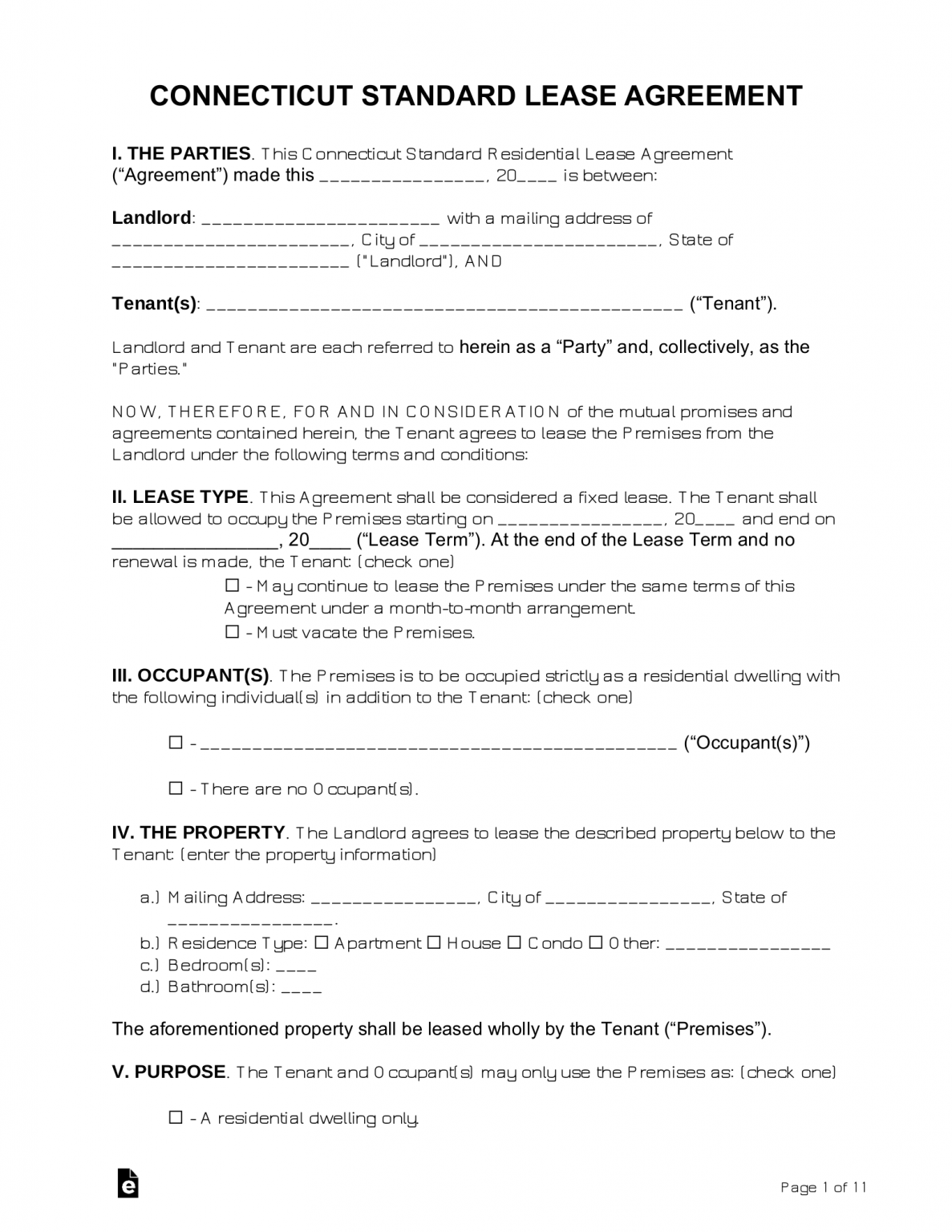

Fl earliest-date homebuyer system standards

Florida Housing also provides different basic-go out homebuyer programs, also advance payment assistance money you won’t need to pay-off if you do not promote your residence, otherwise which can be totally forgivable over a period of big date. Make an effort to see specific eligibility standards, together with a minimum credit history and a maximum debt-to-earnings (DTI) ratio.

Issues Should be aware of

To be eligible for Florida’s very first-go out homebuyer software, you will likely need certainly to see money limitations. These types of limits are usually in line with the median income on area the place you real time. You can search in the average earnings close by having fun with new You.S. Company away from Homes and you may Urban Innovation (HUD) average money members of the family browse unit. Getting Florida’s programs, you can also find the newest restriction you must get into having fun with Fl Housing’s wizard device.

Federal earliest-go out homebuyer programs

First-date homebuyer programs are often based on a vintage loan system available to the customers. You can always need to qualify for among lower than funds, plus fulfilling new criteria set because of the Fl Houses for the support you are looking to.

> Old-fashioned loans. Traditional loans try not to fall into a national financing category. Federal national mortgage association and you will Freddie Mac computer for each and every bring a primary-time homebuyer traditional mortgage that provides an effective step three% advance payment and certainly will be used combined with a florida first-date homebuyer advance payment assistance system.

> FHA fund. FHA fund is actually insured because of the Federal Property Administration (FHA) and gives borrowers off money as little as step 3.5% with a credit score regarding 580 or even more, or ten% having a credit history off five hundred or even more. This new eligibility criteria be lenient as opposed to those from most other financing applications, and make a keen FHA loan potentially recommended to possess earliest-big date consumers.

> Va fund. Army provider players and you may pros are eligible for a great Va mortgage from Agencies regarding Pros Issues (VA). These loans none of them a deposit normally and have zero requisite minimal credit score.

> USDA money. This type of money are secured by the You.S. Department from Agriculture (USDA) and tend to be aimed toward lowest- and you may middle-money family. However they do not fundamentally want a deposit. USDA money enjoys their earnings constraints in order to be considered, and your household americash loans Monroeville must be for the an outlying city.

Faqs on Florida’s earliest-day homebuyer applications

A first-go out homebuyer are anyone who has perhaps not owned a house during the the previous three-years. You can also manage to qualify if you’ve simply owned a house that have an old mate, or if you possessed a cellular domestic.

- Getting a primary-go out homebuyer

- Has actually a credit rating of at least 640

- Capture a homebuyer degree path

- Qualify for that loan with a performing bank

- Fall lower than income constraints near you

Off money vary with regards to the loan program you select. With conventional funds, you often just need to place step 3% down. Having an enthusiastic FHA financing, you’ll want to place no less than 3.5% down. Compliment of Florida’s earliest-go out homebuyer advice apps, you may be capable of getting a second loan to cover this deposit. You might not have to pay-off which next financing until you sell or refinance your home, or it may be forgiven a chunk simultaneously as you will still are now living in your house.