An identical is oftentimes told you to have vehicle identity financing, cash advances, no-credit-evaluate loans, and you can payday loan

- An individual has an $8,100 equilibrium with a beneficial % attract on a single bank card and you will an excellent $eight,100 equilibrium having % rate of interest to the several other. A P2P bank was happy to lend him $sixteen,000 for 5 ages at an interest rate away from a dozen% and additionally an excellent 5% fee beforehand. The Apr of mortgage is actually %, which is below the interest rate into the one another handmade cards. Ergo, they can use this loan to pay off his mastercard debt at a notably all the way down interest rate.

- A small business manager who need the excess loans to finance an offer due to their business about newsprint who may have an excellent highest likelihood of bringing in a great amount of cash.

- A broke however, high-potential beginner just who need the extra money to invest in a great short term proceed to yet another location in which capable potentially get an excellent esteemed work and you will instantaneously getting a top earner to expend off of the financing.

Sadly, fake or predatory loan providers perform exists. First of all, it is uncommon for a lender to increase a deal in place of basic asking for credit rating, and you may a lender doing this are a telltale indication so you’re able to avoid them. Financing advertised by way of bodily mail otherwise by cellular telephone possess a top risk of being predatory. Generally, such finance incorporate extremely high rates, excessive charges, and also brief payback conditions.

Signature loans and you can Creditworthiness

The fresh new creditworthiness of people is one of the fundamental deciding basis impacting the fresh offer from a personal loan. An excellent otherwise expert fico scores are essential, specially when trying to signature loans at a cost. Those with lower fico scores will get partners possibilities whenever trying a loan, and you will money they might secure usually feature negative rates. Such as for example credit cards or any other loan finalized having a lender, defaulting to your signature loans can damage somebody’s credit rating. Lenders appear beyond credit ratings would exists; they use other variables such as for example financial obligation-to-money rates, steady a job record, an such like.

Consumer loan Software

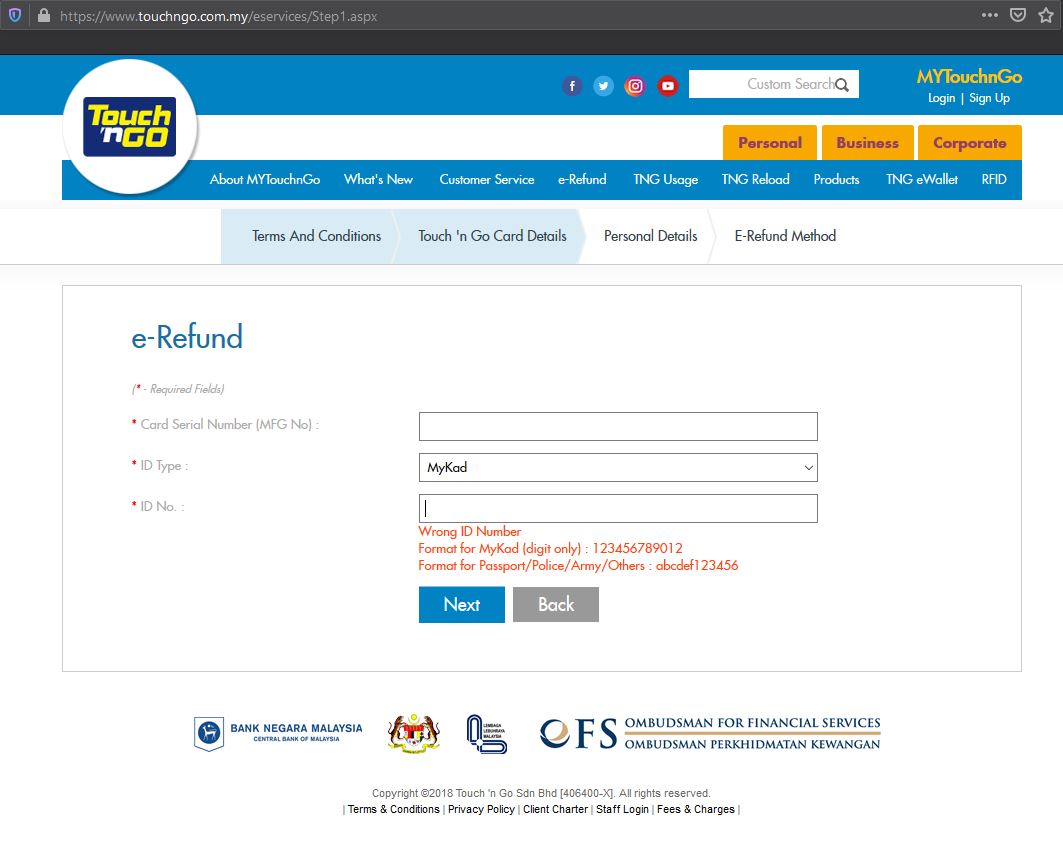

The applying processes is frequently rather simple. To make use of, lenders usually request some elementary suggestions, and private, work, income, and you will credit file pointers, certainly one of some other things. This informative article might come from records including income tax statements, previous shell out stubs, W-dos forms, otherwise your own financial statement. Of a lot lenders today ensure it is consumers add programs on the web. Once submitting, data is reviewed and you can affirmed from the bank. Some loan providers determine immediately, and others may take a few days otherwise days. People can either feel approved, refused, otherwise accepted which have criteria. Regarding the latter, the lender will simply provide if loan places Bucks certain conditions are fulfilled, such distribution more pay stubs otherwise documents regarding assets otherwise expenses.

If recognized, signature loans would be funded as fast as in 24 hours or less, causing them to some handy whenever cash is needed instantly. They must arrive because the a lump sum into the a checking account given when you look at the initial app, as much loan providers want a free account to send personal loan finance through lead deposit. Particular loan providers is send inspections otherwise load currency on the prepaid service debit notes. Whenever paying the mortgage money, make sure to stay contained in this courtroom borders since denoted on price.

Personal bank loan Costs

Together with the regular prominent and you may appeal payments made to your one version of mortgage, for personal funds, there are lots of fees when deciding to take notice regarding.

- Origination commission-Sometimes named a software percentage, it helps to fund expenses associated with processing apps. It typically selections from one% to help you 5% of your amount borrowed. Certain lenders request the latest origination fee upfront some subtract the cost once acceptance. By way of example, $ten,100 lent having a beneficial 3% origination commission will simply net $nine,700 into debtor (new payment has been predicated on $10,one hundred thousand, however).